Work, Life, Balanced

8 Things You Should Know When You Have an 8-Year-Old

By Lynn Shattuck — Feb 11, 2020

Got an 8-year-old? Your child’s becoming increasingly independent in many areas of life—which also means a little more independence for you.

Around this age, your not-so-little one is probably starting to develop their own unique interests, whether they're obsessed with horses or football. It’s a fun time!

We’ve spoken to experts for some of the highlights, challenges and opportunities that come with parenting an 8-year old.

1. Watch Your Child’s Developing Autonomy

By the time your little one turns 8, they've probably reached the following developmental milestones:

Demonstrates a growing vocabulary

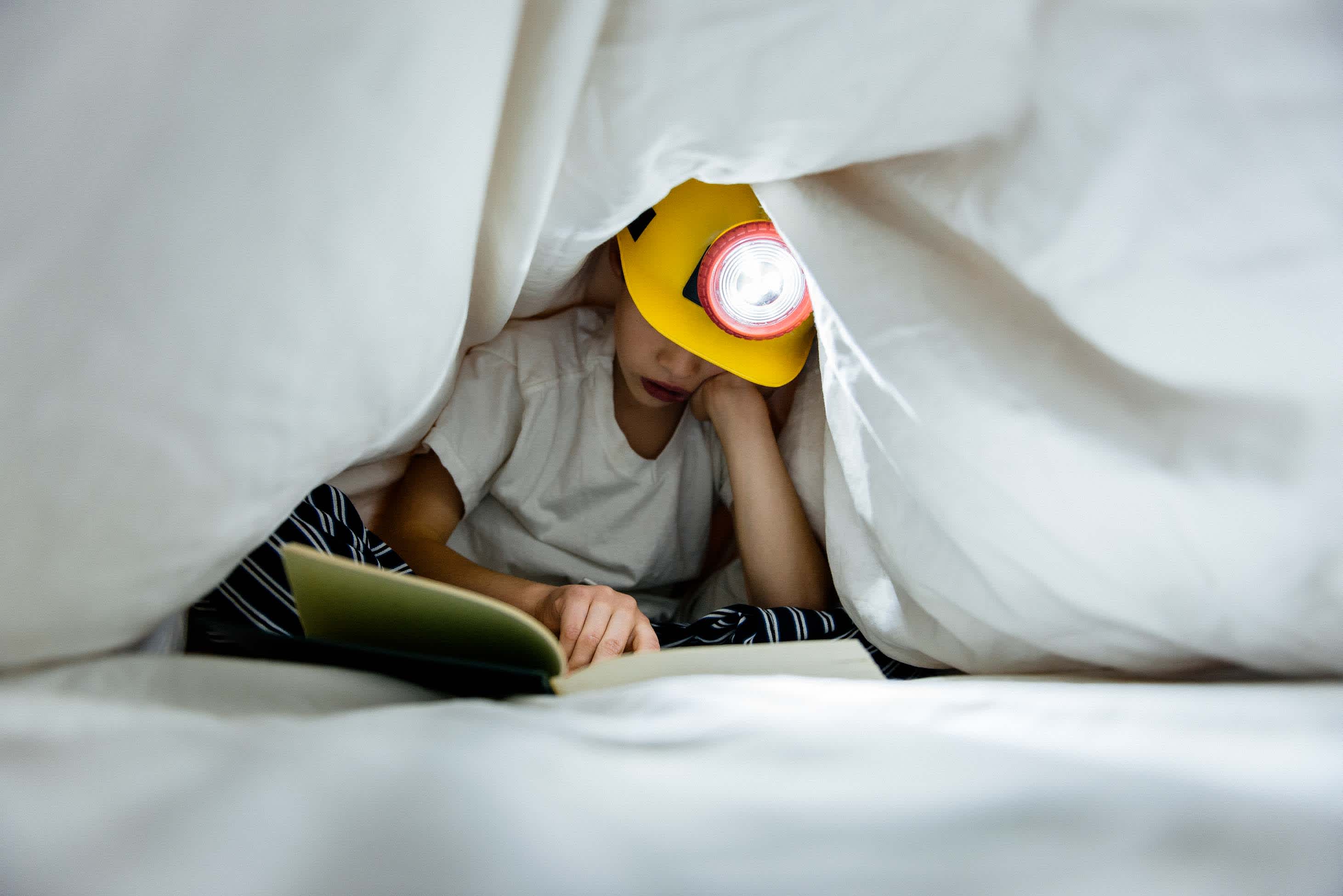

Capable of reading on their own

Strong enough fine motor skills to tie their own shoes and get themselves dressed in the morning (hurray!)

Able to help with simple chores like putting dishes in the dishwasher and folding and putting away laundry

“They’re probably drawing pictures with more details, and coordinating scissors enough to cut out things with multiple curves,” says occupational therapist Keri Ann Wilmot. “They’ve mastered the skills to do basic things and now tend to start paying attention to details for precision and creativity.”

By age 8, your kid is decidedly in the “sweet spot” of childhood: that precious pause between the intense first years of child-rearing and the teen years. Enjoy this time of increasing autonomy. They sure will.

2. Let Them Pay (Technically, at Least)

Harness your child’s emerging independence as an opportunity to convey key money lessons. Erica Sandberg, consumer finance expert and author of Expecting Money, says, “When you’re at a café or a store, hand your kid some cash and let them pay.”

This is an easy way for your child to become familiar with financial transactions. “Have them count the change. This helps kids feel empowered, and these transactions are part of everybody’s life,” she says.

3. Talk About the Cost of Extracurriculars

At 8, children often begin to exhibit unique interests and talents, whether it’s hip-hop dance, guitar or robotics. Another way to start teaching your child about budgeting, comparison shopping and cost-benefit trade-offs is to open up about the costs of their favorite activity—such as sports equipment or other gear.

Approach this matter-of-factly, and be sure not to turn it into a guilt session. “Even if you can afford their equipment, it’s a good lesson about frugality to shop secondhand,” suggests Sandberg.

In addition to saving money, taking this approach teaches your kids about delayed gratification. “It teaches your kids how to be smart about money. You’re teaching them the power of the pause,” she notes.

Check out Craigslist, used sporting equipment stores like Play It Again Sports and Freecycle, or see if your community has a group for families looking to sell, swap or give away gently used sports gear.

4. Make Time for Thinking

Even with their budding interests, 8-year-olds are still decidedly children who need adequate play and downtime, Wilmot reminds. Overscheduling is rampant these days, so make sure to carve out time for play and relaxation into your family’s schedule.

Some families carve out particular evenings or weekend days to simply be together, play games and catch up on housework. To help your kid—and you—unwind, consider anything from family yoga to a meditation app or a dance party.

5. Set Clear Buying Expectations

Do you dread taking your 8-year-old shopping because of the inevitable whining for more toys? Sandberg suggests a solid solution: “My mom would tell us that we’re going to the shoe store and she was buying each of us a pair of shoes—and that was all.”

By setting the expectation ahead of time, you and your child have an established boundary to fall back on. This also models the positive behavior of planning out purchases and avoiding impulse shopping (and spares your wallet, too).

6. Keep a Clear Head Through College Craziness

As the parent of an 8-year-old, the idea that you only have about a decade to save for college can be panic-inducing. Especially if you feel like your own financial house isn’t in order.

“Take care of your own nest first,” urges Sandberg. If you have credit card or other consumer debt, focus on paying that down before you start building a college nest egg for your child. You might also think about consolidating your credit card debts to make repayment simpler and, ideally, gets you a lower interest rate. “Debt erodes your ability to give to your child,” she says.

If your financial situation isn’t ideal but saving for college is important to you, start taking steps to improve your finances. With about ten years to go, you still have time to save, but now’s the time to get going. Consider meeting with a financial advisor to craft a plan to pay down debt, decide on a college savings goal and free up money for your child’s future.

7. Double Check Your Estate Plan

If you haven’t recently reviewed your last will and testament, take a look and see if it needs any revisions.

Specifically, you may be due for an update if you’ve experienced any major life changes since creating your will. This could include adding another child to your family, changing your mind about your child’s guardian or shifting your marital status.

Haven’t made a will yet? You can create one with Fabric’s free online will kit.

Same goes for your life insurance policy, if you haven’t looked at it in a while. You might want to change the beneficiary you’ve chosen if something in your life has changed. You might also want to update your coverage amount if your family’s needs have changed.

If you don’t have life insurance, Fabric can help with that, too. You can apply for term life insurance online in about 10 minutes.

8. Put a Positive Spin on Work

Even if you loathe your job, Sandberg suggests putting a positive spin on it so your kids learn to see working for a paycheck as a natural part of life. “Instead of saying that work sucks, you could say, ‘I’m off to work because it’s important for me to be able to pay the bills,’” she says. “Speaking about work in a positive way is one of the easiest ways to teach your kids about money.”

Of course, if your job is truly making you miserable, it’s OK to be open with your child and let them know you’re looking into other options.

If you love your gig, let your child know that, too. In fact, this is the ideal age to get involved with the National Take Our Daughters and Sons to Work Day, recommended for kids ages 8 to 18. The program was designed to break down gender limitations, expose children to the working world, and spark conversations about work between kids and parents.

When it comes down to it, 8 is pretty darned great. You’re no longer changing diapers but your kid might still be willing to hold your hand at the grocery store. We can attest from experience: Life doesn’t get much better than that.

What new developments will next year hold for you? 9 things to know about 9-year-olds. Or check out what you should know about your kid's development at every age.

Fabric exists to help young families master their money. Our articles abide by strict editorial standards.

Information provided is general and educational in nature, is not financial advice, and all products or services discussed may not be offered by Fabric by Gerber Life (“the Company”). The information is not intended to be, and should not be construed as, legal or tax advice. The Company does not provide legal or tax advice. Consult an attorney or tax advisor regarding your specific legal or tax situation. Laws of a specific state or laws relevant to a particular situation may affect the applicability, accuracy, or completeness of this information. Federal and state laws and regulations are complex and are subject to change. The Company makes no warranties with regard to the information or results obtained by its use. The Company disclaims any liability arising out of your use of, or reliance on, the information. The views and opinions of third-party content providers are solely those of the author and not Fabric by Gerber Life.

Written by

Lynn Shattuck

Related Posts

Work, Life, Balanced

CFPs, Money Coaches and More: Which Financial Professional Is Right for You?

A financial professional can help you manage your money. What type of financial pro you need can depend on the kind of help you’re looking for.

By Jessica Sillers

Work, Life, Balanced

What Parents Need to Know About Taxes in 2025

Tax credits or deductions can help families lower taxes and keep more money to enjoy with your kids.

By Jessica Sillers

Work, Life, Balanced

Does Your Partner Lie About Money? Ways to Find—and Fix—Financial Infidelity

Financial infidelity, or being dishonest about money with your partner, can affect your finances and relationship. Spot unhealthy patterns and learn ways to build money habits that strengthen your bond.

By Jessica Sillers

Fabric Picks

Saving/Investing for Kids

Tax Updates Parents Need to Know in 2026

New tax laws may affect the credits and deductions you can claim on your tax return. Get info on tax updates that may apply to you.

By Jessica Sillers

Life insurance

Places to Get Emergency Cash, Ranked From Best to Worst

When money’s tight, you need funds quickly. These ranked options can help you find your best source of emergency cash without hurting your financial future.

By Jessica Sillers

Life insurance

How to Juggle Long-Term Financial Goals When You’re in the Thick of Parenting

It can be hard to save when current expenses take priority. Tips to save for retirement and manage a family budget.