Life Insurance 101

Life insurance is an unbreakable promise that the people you care about will be taken care of financially when you’re gone. A life insurance company makes you this promise when you buy a policy. You can decide in advance how long you want the promise to be good for, and how much help your loved ones will need. Read more here.

Life Insurance 101

Life insurance is an unbreakable promise that the people you care about will be taken care of financially when you’re gone. A life insurance company makes you this promise when you buy a policy. You can decide in advance how long you want the promise to be good for, and how much help your loved ones will need. Read more here.

Who needs life insurance?

Short answer: you. Long answer, anyone who has people in the world they care about, especially if those people depend on them. Parents, people with outstanding debts, and those who make significantly more than their partner might find it especially helpful. More.

What if I’m covered through my work?

That’s a great start! But it’s just a start. Work-based policies often pay far smaller sums than your loved ones will really need. They can also disappear at inconvenient times - like when you’re between jobs. Getting a policy of your own removes any doubt. More.

How big of an insurance policy do I need?

Any number is better than nothing, but financial experts usually recommend a policy that can pay out 5x your annual salary. Your unique lifestyle can push this number higher or lower. Whatever your needs are, though, we probably have a policy that can fit them. More.

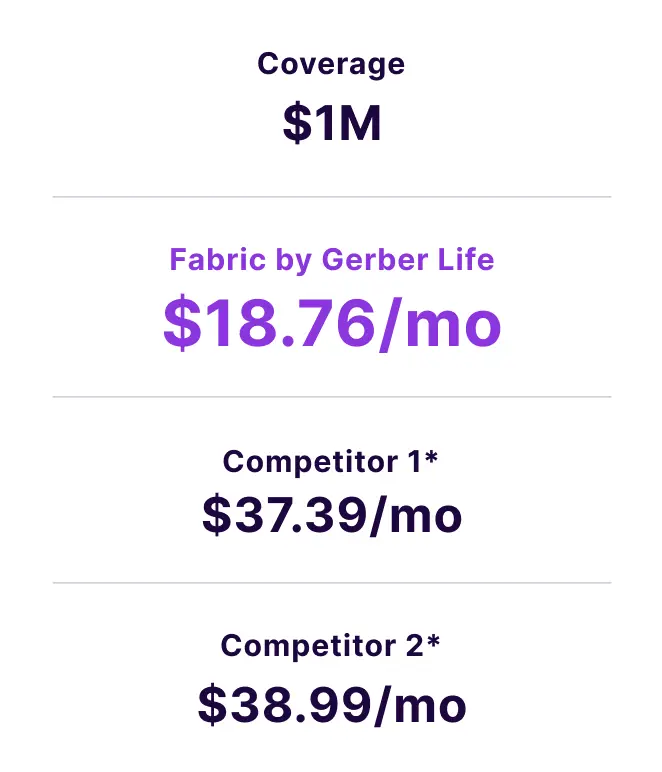

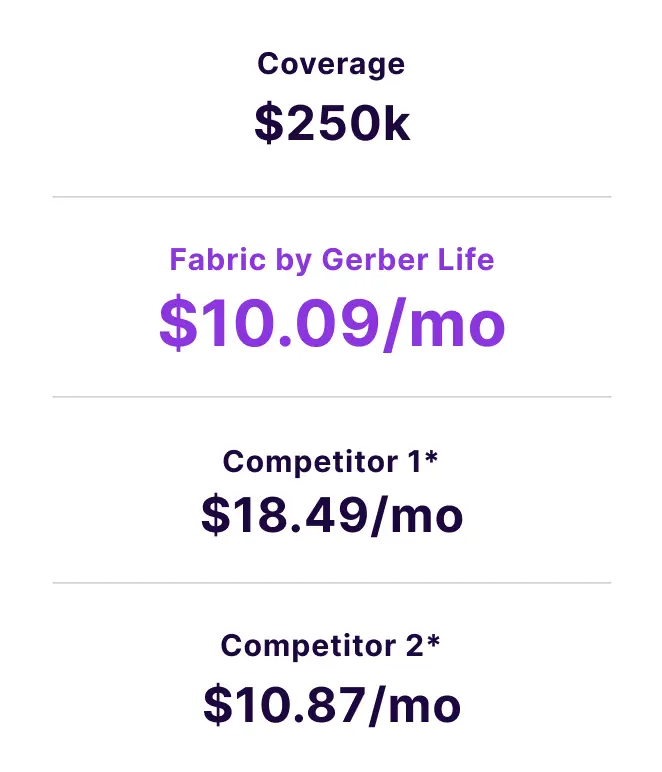

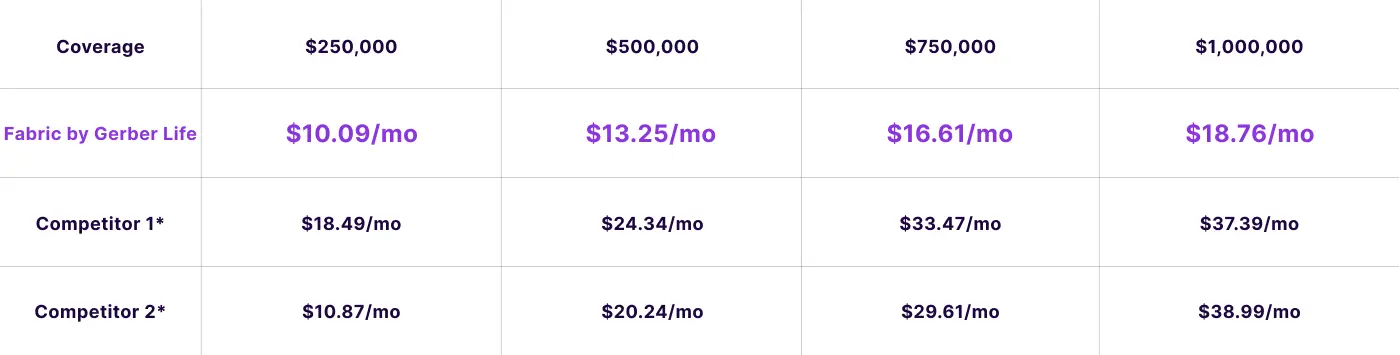

How much does life insurance cost?

Compare some real quotes for 10-year term life insurance. These are example rates, as final prices will depend on a person’s individual situation, and pricing can vary by state.

Take a minute and get an estimate for life insurance that fits your family’s needs.

Life insurance basics: a deeper dive

Life Insurance for Parents: 6 Key Questions You Should Ask

Is life insurance worth it and when is it necessary? We help answer these questions with a few different scenarios. Learn more.

By Jessica Sillers

Do You Need Life Insurance & Is It Worth It?

Securing your family’s financial future is an important plan to cover as a parent. Get answers to the questions parents have about life insurance.

By Jessica Sillers

How Much Term Life Insurance Do I Need?

Life insurance helps support your dependents should the worst case happen. We explain a few methods that experts use to figure out how much you need.

By Lynn Shattuck

Who Needs a $1 Million Life Insurance Policy?

A $1 million life insurance policy sounded excessive... until my partner and I considered everything we wanted to provide for our family. Is it right for you?

By Jessica Sillers

9 Myths About Life Insurance—and What You Should Know

We’ll help you sort fact from fiction, and learn what you need to know about how life insurance really works.

By Allison Kade

Featured Posts

Life Insurance for Parents: 6 Key Questions You Should Ask

Is life insurance worth it and when is it necessary? We help answer these questions with a few different scenarios. Learn more.

By Jessica Sillers

Do You Need Life Insurance & Is It Worth It?

Securing your family’s financial future is an important plan to cover as a parent. Get answers to the questions parents have about life insurance.

By Jessica Sillers

Featured Posts

How Much Term Life Insurance Do I Need?

Life insurance helps support your dependents should the worst case happen. We explain a few methods that experts use to figure out how much you need.

By Lynn Shattuck

Who Needs a $1 Million Life Insurance Policy?

A $1 million life insurance policy sounded excessive... until my partner and I considered everything we wanted to provide for our family. Is it right for you?

By Jessica Sillers

9 Myths About Life Insurance—and What You Should Know

We’ll help you sort fact from fiction, and learn what you need to know about how life insurance really works.

By Allison Kade

Feeling curious? We’ve got the cure.

How to get life insurance

Start by doing your research

Think about how much coverage you need, based on how much it’ll take to protect your family. You might also total up costs like final expenses, debt repayment, mortgages, college costs for your kids, day-to-day living expenses for your family and more.

Then you’ll want to decide what term length is right for you. How long do you want this coverage to last?

For example, if you have a 5-year-old and choose a policy with a 20-year term, then your family would be covered until your child is 25 years old.

Then make it happen

For a sense of how much insurance might cost you, get a free quote. It takes a minute and can set your expectations. Of course, that’s only an estimate because your real price will depend on a more thorough look at your personal situation.

From there, fill out a life insurance application. This generally takes about ten minutes and will ask you questions about your health and medical history, employment, hobbies and other factors. If you’re approved on the spot, you’ll have an opportunity to purchase your policy then and there. If the underwriters have questions about your application, they’ll reach out.

Your free quote is just clicks away

Wait, you want more?

15 Different Types of Life Insurance: What You Should Know

5 Questions to Ask About 10-Year Term Life Insurance

15-Year Term Life Insurance: 5 Types of People Who Should Consider It

Is 20-Year Term Life Insurance Worth It?

Life Insurance and Wills: If You Have One, Do You Need the Other?

More questions?

We love that you’re as interested in this as we are. Reach out to our licensed insurance agents. They know a lot and don’t work on commission.