Life insurance

A Visual Guide to Choosing the Right Life Insurance for Your Family

By Jessica Sillers — Aug 7, 2023

In this article

Life insurance can offer an important source of financial protection and security for your family. People seek out life insurance for different reasons, so it’s important to find a policy that offers the benefits you value most.

Life insurance comes in two main categories, term and permanent insurance. Term life insurance offers coverage for a specific period of time. When the term ends, you’ll need to shop for a new policy if you want continued coverage. Many families prefer term life because premiums are much lower than comparable permanent policies. Whole life is a popular form of permanent life insurance. It offers a guaranteed death benefit as long as your policy is active, and you can build funds in a cash value component that you can borrow from while you’re alive. Lifelong coverage is an important advantage, but premiums are considerably higher.

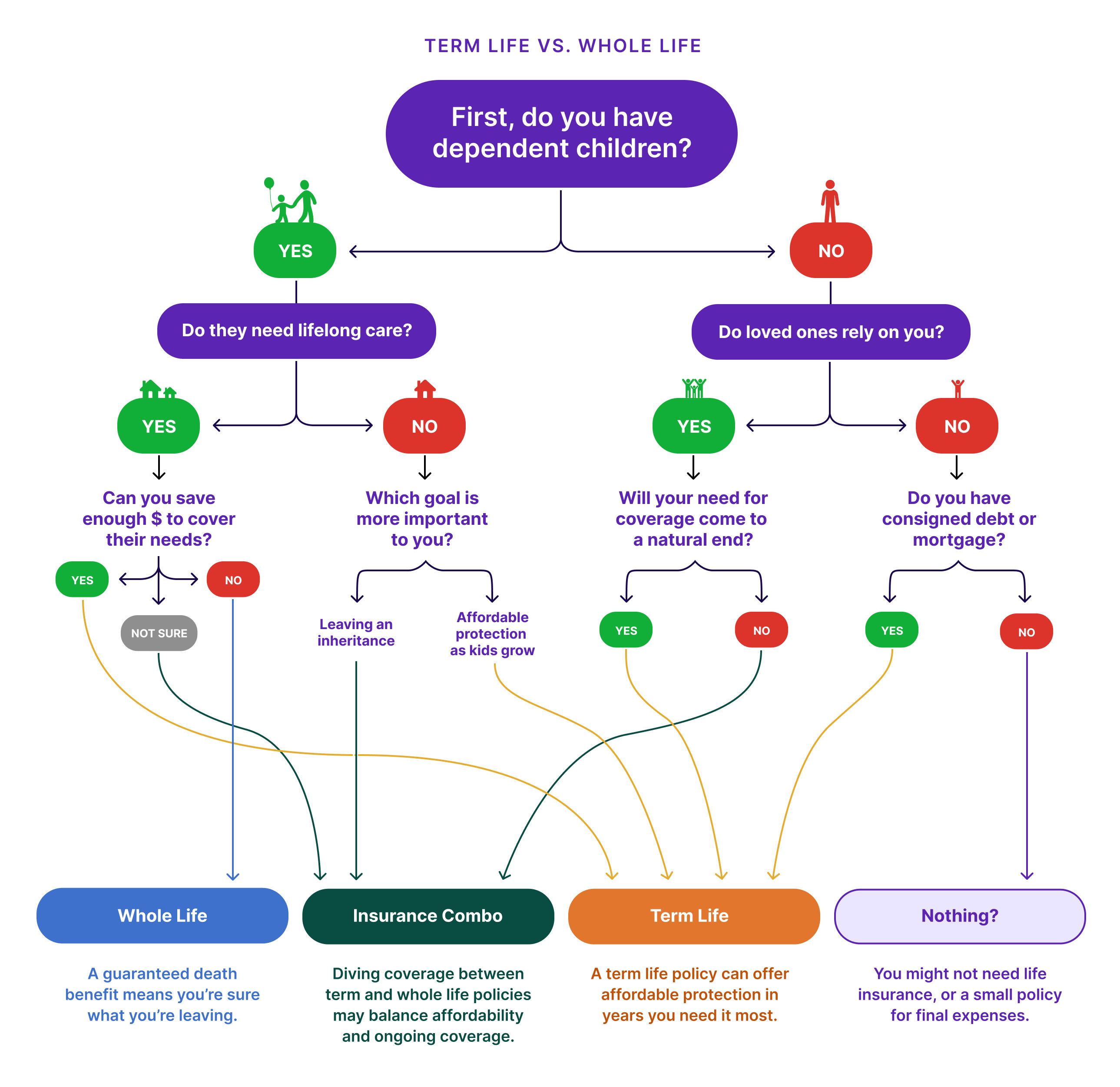

The thing is, while it’s helpful to understand what your life insurance options are, that doesn’t always answer the question of which is best for you. What if cheaper premiums and a guaranteed benefit both sound good? How deep do you dive into research before your eyes glaze over and you give up and flip a coin?

Don’t call heads or tails yet. If you’re on the fence about which type of insurance is right for you, try our easy, just-for-fun flow chart first. You’ll still need to check your result against your real-life situation (family life is complex, and details really do vary), but we can at least help ask the questions that can point you in a helpful direction.

Fabric exists to help young families master their money. Our articles abide by strict editorial standards.

Information provided is general and educational in nature, is not financial advice, and all products or services discussed may not be offered by Fabric by Gerber Life (“the Company”). The information is not intended to be, and should not be construed as, legal or tax advice. The Company does not provide legal or tax advice. Consult an attorney or tax advisor regarding your specific legal or tax situation. Laws of a specific state or laws relevant to a particular situation may affect the applicability, accuracy, or completeness of this information. Federal and state laws and regulations are complex and are subject to change. The Company makes no warranties with regard to the information or results obtained by its use. The Company disclaims any liability arising out of your use of, or reliance on, the information. The views and opinions of third-party content providers are solely those of the author and not Fabric by Gerber Life.

Written by

Jessica Sillers

Related Posts

Life insurance

What Exactly Is in a Life Insurance Contract? A Walk-Through

A life insurance policy is a legal contract. This step-by-step walk-through breaks down details to explain what your policy contract means.

By Jessica Sillers

Life insurance

17 Common Life Insurance Riders: What You Should Know

Riders are additional coverages you can purchase along with a basic insurance policy. Here’s what you should know about life insurance riders.

By Wendy Berkowitz

Life insurance

How to Do an Annual Life Insurance Review

A life insurance review can be part of your financial health. You might be able to make it quick and easy by following our checklist.

By Jessica Sillers

Fabric Picks

Life insurance

Is Life Insurance Tax Deductible?

Many people wonder whether life insurance is tax deductible. The answer is usually no, but there are some exceptions.

By Jenn Sinrich

Life insurance

How Much Term Life Insurance Do I Need?

Life insurance helps support your dependents should the worst case happen. We explain a few methods that experts use to figure out how much you need.

By Lynn Shattuck

Life insurance

How to Stay on Track Financially at Every Age

Life insurance can help be one part of your family’s financial peace of mind. Keep your finances on track at any age to feel prepared.