As seen in

Simple start

Simplified investing

Guided support

Financial flexibility

No hidden fees

Penalty-free withdrawals¹

Easy to try

Cancel anytime²

30 day free trial

See how their account could grow

Move the sliders to see how your child’s account might grow with them through the years. It’s a powerful way you could help them achieve their financial dreams!

$30,270

Monthly contributions

$30

Monthly gifts from others

$50

Years to grow

18

Average annual return

7%

A lifetime of possibilities

An account that grows with them, from childhood into adulthood. By investing for them when they’re young, the money you put in can add up over time and be withdrawn whenever they need it, to help them achieve their dreams.

Tuition

Art classes

Band uniforms

Sports equipment

Tutoring

Any child-related expense

House

Wedding

Baby expenses

Retirement

Emergency

Anything else!

Comparison to a 529 plan?

How does this account grow?

What about withdrawals?

For education...and beyond

Our custodial accounts are UGMA (“Uniform Gift to Minors Act”) accounts. Unlike a 529 plan, which is restricted to qualified education expenses, a UGMA investment account can be used for anything that benefits your child—no matter if it’s when they’re minors, in college, or beyond.

Education

Sports equipment

Travel

First car

Wedding

Mortage

Retirement

Yes! Having both a 529 and a UGMA investment account is a great way to set your child up for financial success at any stage of their life.

Accounts will transfer to your child when they reach an age of majority (varies by state, typically 18-21 years old).

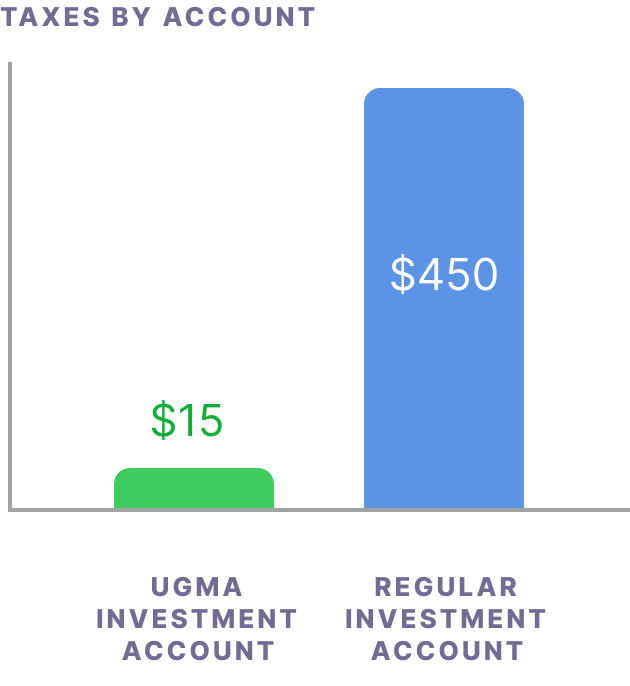

Tax advantages*

In most cases for UGMA custodial accounts, there are no taxes paid each year, or taxes will be much less than in a standard investment account.* See FAQ section for additional details.

First $1,350

Tax-free

Next $1,350

Taxed at the child’s rate

Beyond

Taxed at the parent’s rate

Here’s an example:

Johnny’s account earned $1,500 this year.

How much would he pay in taxes?

Assumes that Johnny is in the lowest tax bracket (10%). Regular investment account would be taxed at the parents’ bracket (30% in this example).

Assumes that Johnny is in the lowest tax bracket (10%). Regular investment account would be taxed at the parents’ bracket (30% in this example).

Big dreams, small fees

You get all this with your account for only $3/mo.²

More than one account? It’s only $5/mo, flat.

Just $3/mo covers:

SIPC-protection up to $500k

Professionally managed portfolios

All trading fees & more²

Flat fee

No commissions

No charges based on percentage of your assets

A trusted way to invest in their futures

Our investment accounts are known as UGMAs. UGMA accounts have been around since the 1950’s and are a trusted way to invest in your child’s future.